Personal Loans Canada Fundamentals Explained

Personal Loans Canada Fundamentals Explained

Blog Article

Rumored Buzz on Personal Loans Canada

Table of ContentsGetting The Personal Loans Canada To WorkHow Personal Loans Canada can Save You Time, Stress, and Money.See This Report about Personal Loans CanadaThe Best Guide To Personal Loans CanadaThe Only Guide to Personal Loans Canada

For some lending institutions, you can examine your qualification for an individual lending by means of a pre-qualification procedure, which will show you what you may certify for without denting your credit rating. To ensure you never ever miss a car loan repayment, take into consideration establishing up autopay if your lender supplies it. In many cases, you may also receive a rates of interest discount rate for doing so.This consists of:: You'll need to confirm you have a work with a consistent earnings so that you can pay back a car loan., and various other details.

Personal Loans Canada Can Be Fun For Anyone

, which is made use of to cover the cost of processing your car loan. Some lenders will certainly allow you pre-qualify for a funding before sending an actual application.

This is not a hard credit rating draw, and your credit report and background aren't impacted. A pre-qualification can help you weed out lending institutions that will not provide you a car loan, but not all lenders use this option. You can compare as several lenders as you would certainly such as with pre-qualification, by doing this you only need to finish an actual application with the loan provider that's more than likely mosting likely to authorize you for a personal funding.

The greater your credit report rating, the more probable you are to qualify for the most affordable rate of interest used. The lower your score, the more difficult it'll be for you to get a lending, and also if you do, you can finish up with a rate of interest on the higher end of what's supplied.

All About Personal Loans Canada

Autopay lets you establish it and forget it so you never ever have to fret about missing a funding repayment.

The debtor does not need to report the amount received on the car loan when filing taxes. If the finance is forgiven, it is thought about a terminated financial obligation and can be strained. Investopedia appointed a nationwide survey of 962 united state adults between Aug. 14, 2023, to Sept. 15, 2023, that had actually gotten an individual funding to find out exactly how they used their financing profits and just how they could make use of future personal loans.

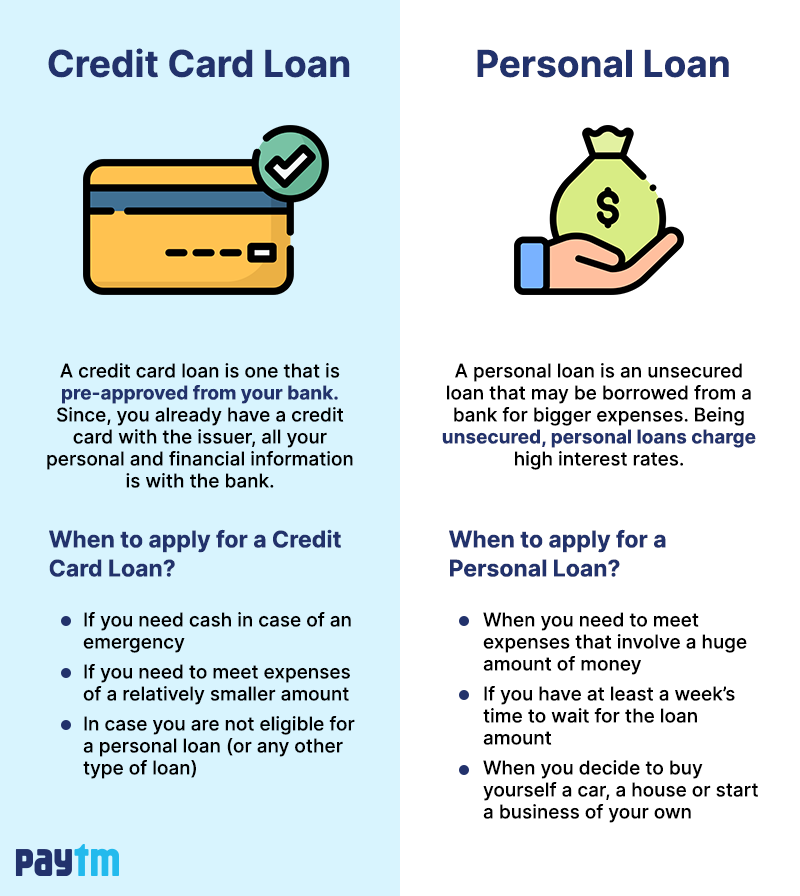

Both individual fundings and credit history cards are two alternatives to borrow money up front, but they have various purposes. Consider what you require the cash for prior to you pick your settlement alternative. There's no incorrect choice, however one could be far more pricey than the various other, relying on your demands.

Yet they aren't for everyone. If you don't have excellent credit, you could need to get the assistance of a co-signer that accepts your funding terms together with you, handling the legal obligation check to pay down the financial debt if you're incapable to. If you don't have a co-signer, you may get a personal car loan with bad or fair credit score, yet you may not have as lots of choices compared to someone with good or exceptional credit report.

Unknown Facts About Personal Loans Canada

A credit report of 760 and up (exceptional) is most likely to get you the lowest rate of interest rate offered for your finance. Customers with credit rating of 560 or below are extra likely to have trouble getting approved for better lending terms. That's due to the fact that with a reduced credit report score, the interest price has a tendency to be too expensive to make a personal loan a feasible loaning alternative.

Some elements lug even more weight than others. 35% of a FICO rating site link (the kind used by 90% of the lending institutions in the nation) is based on your repayment background. Lenders wish to make sure you can manage loans responsibly and will certainly consider your previous practices to obtain a concept of how responsible you'll be in the future.

In order to keep that part of your score high, make all your repayments on time. Being available in second is the quantity of credit report card debt superior, about your credit rating limits. That makes up 30% of your credit report and is understood in the market as the credit score use proportion.

The reduced that ratio the better. The size of your credit rating history, the kind of credit report you have and the variety of brand-new credit report applications you have actually recently loaded out are the various other variables that establish your credit history. Beyond your credit scores rating, lending institutions check out your earnings, work background, liquid possessions and the amount of overall financial obligation you have.

Not known Facts About Personal Loans Canada

The higher your income and assets and the lower your various other financial debt, the better you look in their eyes. Having an excellent credit check history when getting a personal funding is necessary. It not just figures out if you'll get accepted yet just how much passion you'll pay over the life of the financing.

Report this page